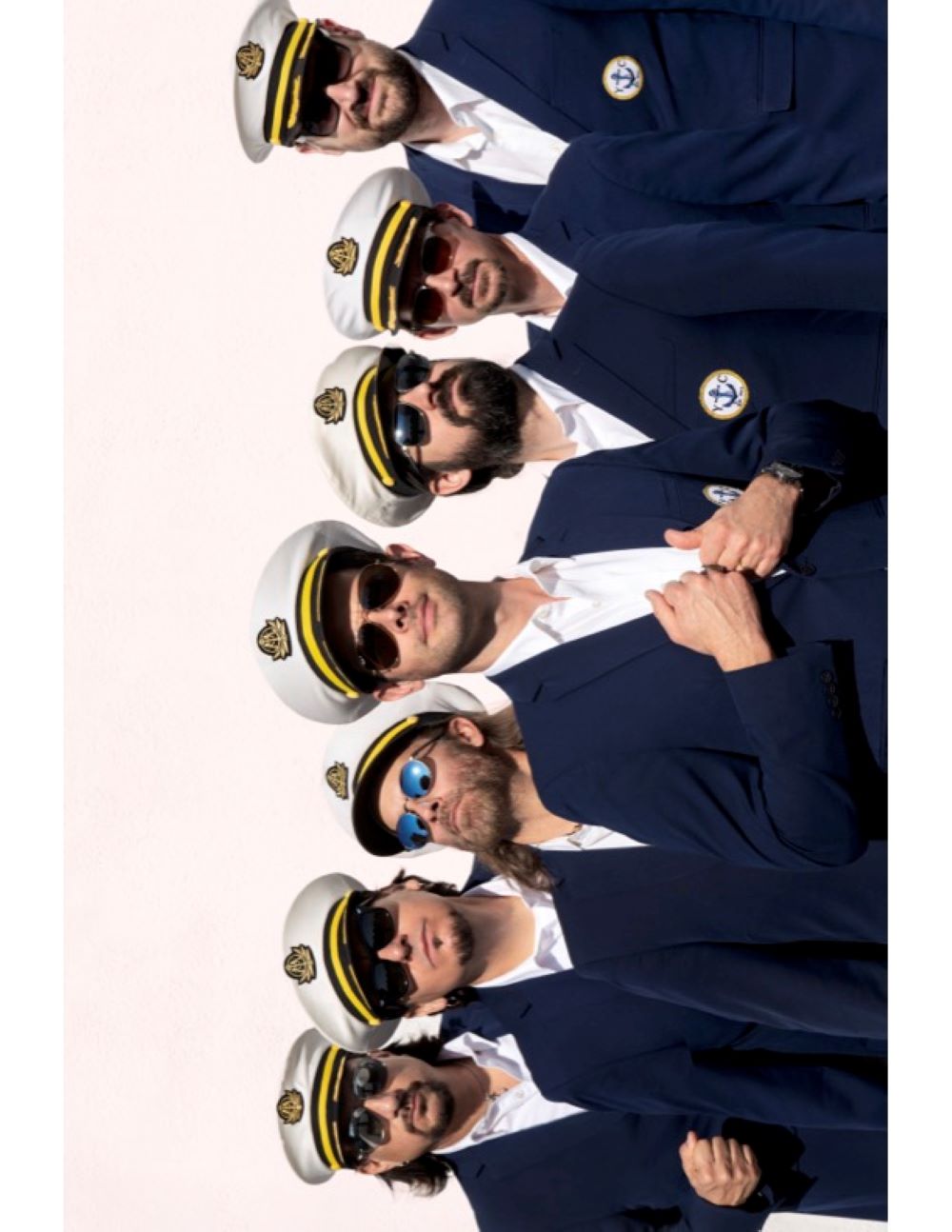

Photos Courtesy of MonCasa & Michael Aumock

Michael Aumock is one of the few destination club professionals who has been in this industry as long as it has been in existence. Due to his years of experience as Director of Membership Development for Quintess, the VP of ViaMari, a high-end yacht destination club, and president of his own consulting company, Delfineo, Michael is the only American chosen to be part of the senior executive team at the MonCasa Private Club Residences, a new equity-based destination club, based in Toronto.

Recently, I interviewed Michael, who will very soon help define the mission, vision and future direction of this new Canadian Club. His insights into the form, function and future of equity and non-equity based destination clubs are unique, as they are experientially based.

JustLuxe: How long have you been in the shared residence field, and what have you learned regarding its ups and downs?

Michael Aumock: I have been involved with shared residences since late '01, managing resort property for some wealthy clients in Colorado's ski areas. While it was short-term rental, the owners involved also used their properties. This gave me some insight as to how people behave when they vacation, and what they expect when they are paying $500 per night or $5,000/night. There isn't that much of a difference.

Michael Aumock: I have been involved with shared residences since late '01, managing resort property for some wealthy clients in Colorado's ski areas. While it was short-term rental, the owners involved also used their properties. This gave me some insight as to how people behave when they vacation, and what they expect when they are paying $500 per night or $5,000/night. There isn't that much of a difference.

It is about service, quality and attention to known details. I'll say that again, because it's one of my guiding principles, attention to known details. Nobody expects you to guess their anniversary, but if it's in the file, and there's no Champagne, you've just failed, even if the rest of their trip is great. Regarding the ups and downs, there are many things that could have been controlled, but weren't. If the industry had kept on the course it was on, there would still be only a few players, but the stronger ones would have bought the smaller ones, instead of having to helplessly watch them fail.

JL: Some have said that the destination club idea is one that has seen better days, and is an idea that has major flaws. What do you say to that?

MA: It's interesting that most of the people who throw stones at DCs could never afford to join one. Until you've spent $20K on a ski trip or a week at the beach, I think it's difficult to appreciate the DC value. We aren't building these clubs for everyone. It's a lifestyle choice. When you commit to a destination club it makes you take vacations. It forces you to take time off and spend it in beautiful places with the people who matter most in the world to you. I'm sorry, I just cant see the downside of that equation. As long as you aren't using the grocery money to join, I think joining a DC is a great use of your discretionary funds.

Furthermore, DCs are still a great idea. For travel, if the club style of vacation fits your needs, it is an unparalleled method of recreation. The challenges are in the nature of clubs, and the business model. But to say that DCs are "bad" because they banked on the real estate market continuing to go up is naive. It was a new sort of business, and with any sort of new business, some make it and rise to the top, and some fail. I would point to Internet search engines. How many search engines were there in 1999 compared with today?

As far as "better days," I think we have yet to see the final product. With clubs like Quintess aggressively making changes to continue to thrive in the new economy, and new clubs like MonCasa Private Club Residences, coming up with a new and ever-evolving way to make the membership as a whole feel safe about their investment - I think the future is a bright one. The nature of clubs is also very deliberate and measured, regarding change. You can't just say something sounds good, and do it. There are too many moving parts. Members are different from clients or customers - they take on the mantle of ownership (real or imagined) and have to be educated and ultimately, delighted.

JL: How do you see the shared residence industry in the future, and how do you see an ideal club? Is there still a market for such a thing?

JL: How do you see the shared residence industry in the future, and how do you see an ideal club? Is there still a market for such a thing?

MA: The shared residence industry will continue to evolve and grow. People want to travel as more and more of life gets funneled to us through our computers and cell phones, so actually "experiencing" something wonderful is going to entail getting on a plane. There is something instinctive here - to explore, to see what's beyond the horizon. There are adventurers in this world, men and women of action who are champions of the workplace and the board room. Their adventure time is far too rare and precious to risk a bad trip with the family. And there is no greater experience you can share with your family than discovery.

The magic part of destination clubs is that they virtually remove the possibility of a bad trip. The club sees to it that you have an AMAZING trip and if they fall short, and the weather is lousy, and the beach is closed, you still have a GREAT trip, because the club has you backed up in so many different directions, with so many other things to do. An ideal club is a subjective term; it's like an ideal mate. What works for me might not be perfect for the next guy. I think the future holds some diversity for clubs; the models will start to solidify in some ways, and get even more flexible in others.

Clubs will try different things to keep their members interest. It will become more experiential and less real estate based, but there will always be some real estate holdings that make sense, Cabo, Hawaii, Aspen, Napa, etc. But as long as there are executives who feel guilty about not spending enough time with their families, there will be destination clubs.

JL: What has your Quintess and your ViaMari experiences taught you?

MA: I'm very lucky to have had the experience with Quintess, in that I was surrounded by some of the best minds in the business on a daily basis, and I learned a lot about what works in this industry. I learned about customer loyalty, delivering what you promise. ViaMari, a luxury fractional yacht club was a great idea - seriously great. Timing? Not so much. ViaMari was a reminder that timing is everything.

JL: What does it take, in your opinion, to be a great industry leader, and one who could actually run a destination club?

JL: What does it take, in your opinion, to be a great industry leader, and one who could actually run a destination club?

MA: You have to have drive and vision to run a club. You need two sets of ears, one set to listen in earnest to everything that every member wants you to know about their opinion of how you should run their club, and a second set to hear what is happening in the real world that effects the club: real estate, changing global travel preferences, new destinations, bankrupting developers, crooked politicians on small islands - all of that and ten thousand other different things need to be part of your daily diet.

Wisdom, that's an important one. You have to realize that it's not YOUR club; you have to check your ego at the door. If you let your ego affect your decision-making, you are serving yourself, NOT the membership. You will fail. You have to be a motivator, of members and staff alike. It helps to be able to get by on five hours sleep, and to be able to travel at the drop of a hat and live out of a carry-on for nine days in four countries.

But in addition to all that, you have to surround yourself with excellence. You can't be on the road for nine days, five of which you don't have cell coverage, if the club is falling apart in your absence. You need capable people who are on the same mission you are on, who aren't immobilized by fear if they have to make a decision in your stead.

JL: Do you see any clubs out there that have the DNA to make a great club and have the staying power to be a great club for the next number of years?

MA: Yes, I see several. DNA isn't just on the club side - it's on the member side as well. Great members make a great club, which is why Quintess is at the top of the list in the U.S. Those members made a tough decision three years ago, but as a group I think they feel some solidarity because of it. Equity Estates is experiencing growth of late. ER (Exclusive Resorts) has some challenges ahead, but has retooled and is ready for another significant growth spurt. The Hideaways Club in the UK is looking good. Additionally, I would like to think any new club that was well funded, and had the sense to learn from the mistakes of those who went before them, would be able to capitalize on a deflated real estate market, and a more educated consumer.

JL: What does the future hold for you? How do you see the shared residence industry in the next ten years?

MA: In general, I see the industry continuing to stratify over the next few years; there will become a bigger chasm between clubs that control real estate, and clubs that don't. When rental prices start to climb again, (and they will), so-called destination clubs that don't control property will have to show their true colors and be seen as the glorified VRBOs that they are. I'm not saying it's a bad thing, it's not. But it's not a destination club, either. As for me, I will be spending a lot of time in Canada, doing my best to ensure that MonCasa hits the ground running, and looking for the closest Tim Horton's.