The art world is a very fickle place and the value of a particular work can be very subjective. Even those of us who have spent our entire lives in it, and are considered experts in their specific field, cannot guarantee which works will perform better than others over a period of time. We can give our best educated guess, but it is still a guess. The manta "only buy what you like" should be strictly adhered to in the art world since the works you buy are going to hang on your walls ... at least I hope they do. If you buy good quality works, that are in excellent condition and from the "right" period for a specific artist, you should, in the long run, do well financially. But is the "long run" 5, 10, 15 or 20 years? Only time will tell.

Over the years, Traditional (Old Master, 19th century and Impressionist) and historically important Contemporary art have proven to be the most financially stable and rewarding -- providing their owners with a good return over a protracted period of time. However, in extremely difficult financial times even those periods will be impacted to varying degrees.

Most art buyers and collectors should realize that if they own a diversified collection they actually have their own art fund hanging on their walls. So is it really necessary to pay some financial "guru" both management and percentage of profit fees for something you can do yourself?

Now if someone really feels the need to create another art fund here is an interesting concept ... bring together the best dealers from each of the different fields as advisors -- the good ones not only know the difference between a good and bad quality work, but what will and will not sell. With that sort of advice, you may have the ingredients for a successful venture.

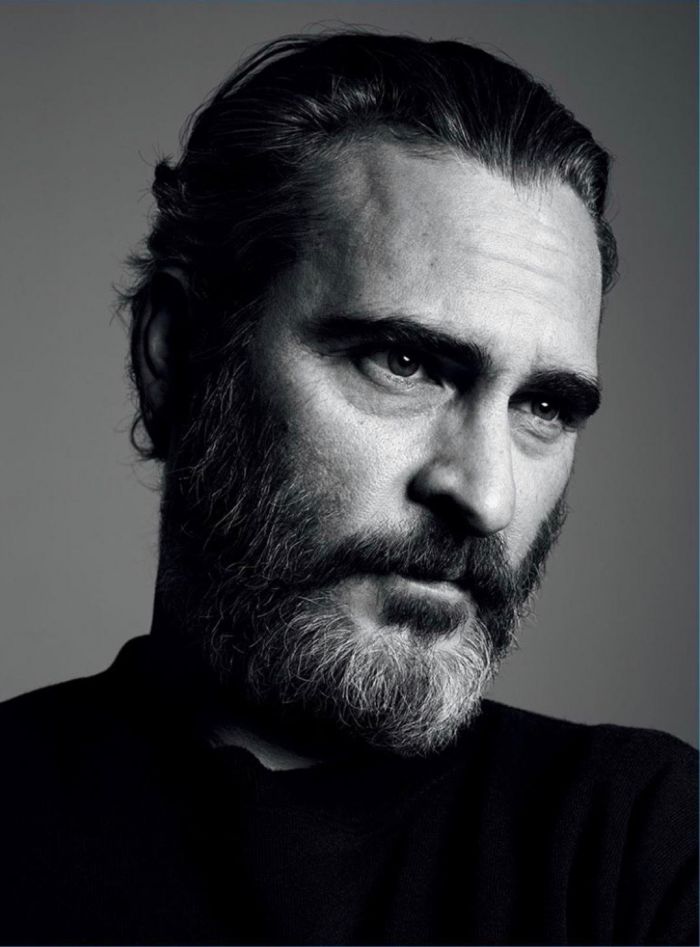

Howard L. Rehs

Rehs Galleries, Inc, New York City

www.rehs.com